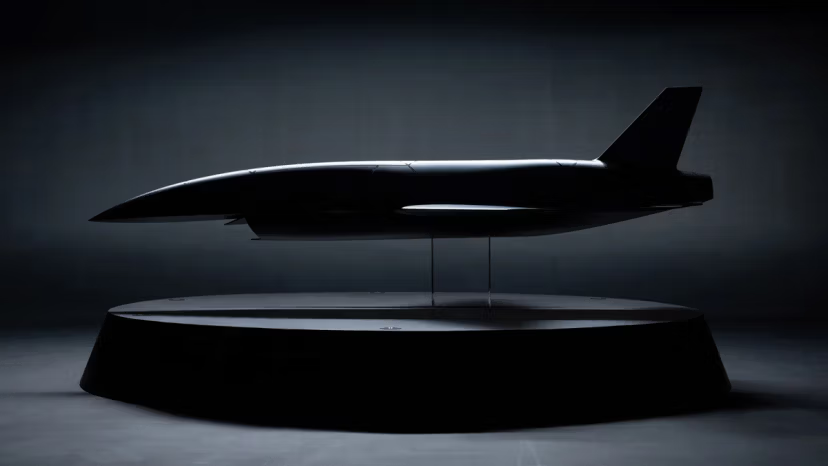

We align with brands and technologies reshaping our culture

Portfolio

Our Approach

01. Strategy

At Align, our strategy is built on conviction at the earliest stages and support across the entire capital stack. We are often the first venture check, helping founders prove product–market fit and build momentum, but our platform is designed to grow with them—providing meaningful follow-on capital, secondary liquidity, and access to our expansive co-investment network.

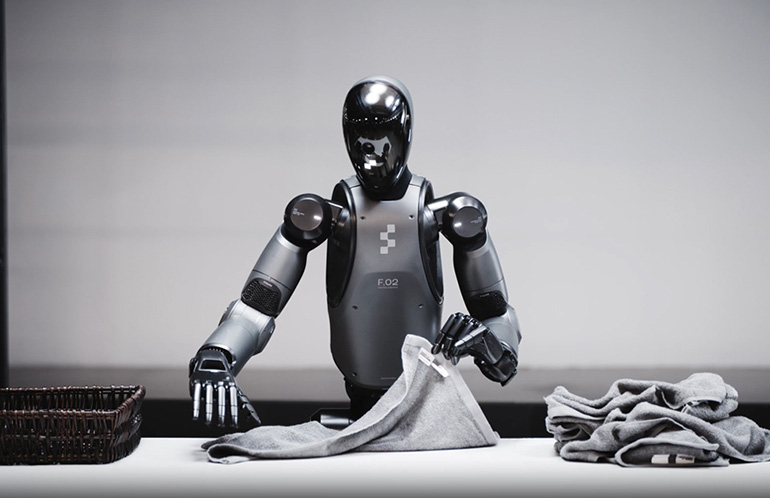

02. Focus

Our focus begins with consumer brands—health & wellness, longevity, experiential retail, and next-generation CPG—but extends to select technologies that reshape culture itself. From AI to robotics, we partner with companies that transform how people live, connect, and thrive.

03. Partnership

What sets Align apart is not just capital, but partnership. We take board seats, provide hands-on guidance, and bring the weight of a global network spanning founders, creators, operators, and acquirers. This active approach, combined with disciplined risk management and governance, enables us to accelerate growth while protecting downside.

04. Outcomes

With Fund I among the top-decile of its vintage and Fund II expanding our reach, Align is building the cultural-defining companies of tomorrow—brands and technologies that endure.

05. Network

But capital and guidance are only part of the equation. The real strength of Align lies in the network we’ve built over more than a decade—an interconnected community of founders, creatives, investors, and acquirers who collectively create enduring value for our portfolio.

Founders

Creators

Investors

Advisors

Acquirers

Managing Partners

Ben Bryce

Founder I Managing Partner

Ben is the founder of Align Ventures and brings over 15 years of consumer investing, capital raising, and portfolio management experience to the firm. He serves on the boards of Coterie, Radar, Jinx, Nurture Life, Next Health, and Silo.

READ MORE

Grant Hosking

Managing Partner

Grant brings more than 15 years of venture capital, investment banking, operating, and private equity experience to Align Ventures. He sits on the boards of Figure and Scout. From 2007 to 2018, he served as Vice President and Director at Stifel.

READ MORETeam

Neel Chary

Partner, Growth Capital

Neel joined Align Ventures in 2021 and brings nearly 20 years of experience across venture capital, investment banking, private equity, and alternative investments. He currently serves on the board of Terzo AI and as a board observer for Radar.

READ MORE

Chris Gardner

Venture Partner

Chris joined Align Ventures in 2022 and has 12+ years of venture capital, investment banking, and private equity experience. Previously, he was a Vice President at Stifel, where he executed 40+ M&A transactions, financings, and restructuring deals

READ MORE

Greer Love

Venture Partner

Greer joined Align Ventures in 2025, bringing 20 years of experience in investment banking and private equity. Previously, he founded Lenox Partners, an NBA agency that supported athletes with contract negotiations, marketing, and family office creation.

READ MORE

Leif Lundaas

Venture Partner

Leif joined Align Ventures in 2024. He brings 15+ years of buyside experience from both public and private markets, investing across industries and geographies. Before Align, he was a lead Midstream research analyst for Pickering Energy Partners.

READ MORE

Andrew Ferrero

Vice President

Andrew joined Align Ventures in 2024 and focuses on consumer and technology investments. He previously served as an Investment Banking Associate at Presidio Technology Partners, advising software and e-commerce companies on M&A transactions.

READ MORE

Melanie Singh

Senior Analyst

Melanie joined Align Ventures in 2025 and focuses on early-stage consumer investments. She previously worked at The Estée Lauder Companies on the New Incubation Ventures team, investing in emerging prestige and luxury beauty brands globally.

READ MORE

Matt Hare

CFO

Matt joined Align Ventures in 2026 and supports the firm’s financial reporting activities. He brings more than 20 years of principal investing and financial management experience. He previously served as partner and CFO at Huron Capital.

READ MORE

Nik Kolluru

COO

Nik joined Align Ventures in 2021 and brings 15+ years of operational leadership experience. Nik supports the firm’s evolution and its long-term growth. He specializes in helping organizations reach sustainable growth by aligning strategy, execution, and teams.

READ MOREJeremy King

Senior Director of Financial and Operations

Jeremy joined Align Ventures in 2025 and brings more than 25 years of experience in the alternative asset management space, with expertise in finance and operations of hedge funds and alternative investment accounts.

READ MORE

Harsh Gill

Operations Associate

Harsh joined Align Ventures in 2025 and focuses on fund operations, SPVs, and investor onboarding. He brings over 9 years of experience spanning consulting, financial operations, and entrepreneurial ventures.

READ MORE

Justin Dennis

Senior Operations Associate

Justin joined Align Ventures in 2025 and focuses on fund operations, investor relations, and fund accounting. He brings over 8 years of experience spanning financial operations, wealth management, and fund accounting.

READ MORE